Ellie Mae recently provided information on the loans flowing through their platform. They are a software provider that was founded in 1997 that many community banks utilize. Right now, they are handling almost a quarter of the loans made in the United States. That’s a decent % and the data they provide is a good reflection of the actual mortgage market.

The March data looks like this: 63% of their mortgages were purchase, and 37% were refi, a significant change from the past nine months. Refi’s had been running in the mid to high 40’s. The time to close (all days) was an across the board 43 days.

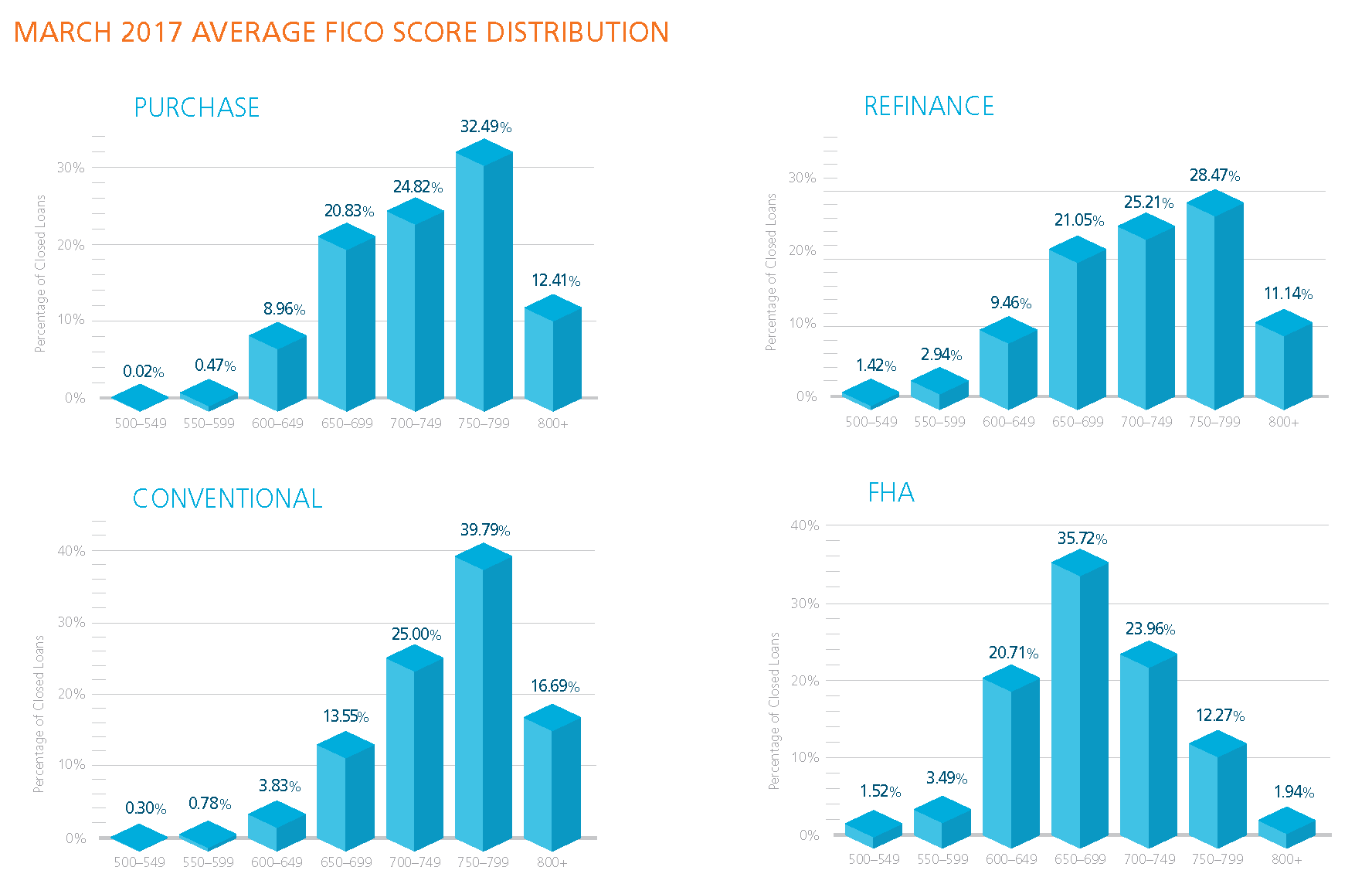

What I found really interesting was the FICO scores. The average score on all closed loans increased slightly in March to 721. Below are graphs of the average FICO score distribution for All Purchase, Conventional, Refinance, and FHA.

So compare this info to what your bank is doing. In my experience community banks tend to lead on performance for closing days. Service, like SAMCO, is what they provide and sell!

See full reports from EllieMae: Origination Insight Reports

Comments ()